Fee Basics

This section provides basic information about developing a stormwater utility fee, including its characteristics, beneficial features and potential fee structure design issues.

Distinguishing Characteristics of a Successful Stormwater Utility

The “Clean Stormwater and Flood Reduction Act” (enabling statute), which was passed by the New Jersey legislature in March 2019, enacted into law a series of statutes authorizing the establishment of a stormwater utility.

When stormwater utilities are funded by a “user fee”, there must be a reasonable relationship or “rational nexus” between the cost of service recovered through the user fee and the amount charged to rate payers. Besides being vital for the political acceptance of the program, it is important from a legal perspective, as the courts have consistently upheld various fee charges on this basis (which distinguishes a “fee” from a “tax”).

Basically,

- -First, there must be a reasonable nexus between fee revenues and stormwater management expenditures. This is consistent with the enabling statute, which defines “stormwater management system” as including equipment, plant, structures, management and design practices, planning activities, or land, or any combination thereof used to convey stormwater, control or reduce stormwater runoff and associated pollutants or flooding, induce or control the infiltration of groundwater recharge of stormwater, or eliminate illicit or illegal non-stormwater discharges into stormwater conveyances. Hence, the fee must be limited to the full or partial recover of costs related to stormwater management. Per the enabling statute, this nexus between fee revenue and how it is spent must be documented in the utility’s annual report and published on the entity’s website.

- -Second, the fee or charge assessed on any real property must be reasonably based on a “fair and equitable approximation” of the proportion of stormwater runoff that a real property contributes. The use of impervious coverage as the basis to approximate the proportionate contribution and to establish the stormwater utility fee is a widely accepted best industry practice. See NACWAs “Navigating Litigation Floodwaters” here for a list of other potential legal concerns.

Most local stormwater programs in New Jersey are funded from the property tax, which has two inherent weaknesses from an equity standpoint. First, there is no correlation between the value of property and the amount of stormwater runoff that it generates. Second, tax exempt properties such as universities, hospitals, and government institutions, which also contribute runoff, do not pay towards the cost recovery of stormwater management costs. Under the tax revenue funding of stormwater, those properties are subsidized by local taxpayers.

Conversely, a stormwater utility fee that is designed on the basis of impervious area can reflect a reasonable correlation with the amount of stormwater runoff contributed by each property. Fee charges are based on impervious coverage, hardened surfaces such as driveways, roofs, and sidewalks. Essentially, “the more runoff, the higher the fee”. As New Jersey’s enabling statute exempts only land “actively devoted to agricultural and horticultural use” that is taxed pursuant to the “Farmland Assessment Act of 1964”, the stormwater management costs can be more equitably recovered from all other properties that contributed runoff when the user fees or charges are based on impervious area.

The user fee provides a funding mechanism that is dedicated to support stormwater management activities and thereby affords a certain level of funding reliability. To protect against legal challenges and to address concerns over the potential diversion of funds to other pressing budget needs, the enabling statute requires that all fee revenue be dedicated solely to stormwater-related expenses. All stormwater utilities must file a financial report annually with the Department of Community Affairs, which is typically certified by the local chief financial officer, and those established within a local authority must discretely budget and account for their revenues and expenses.

By providing a stable source of funding, a stormwater utility enables timely capital investments in infrastructure and supports consistent operations and maintenance (O&M) of the stormwater management system. Presently, stormwater spending may take the form of unplanned or reactive emergency actions that are costly and sometimes ineffective. A consistent and dedicated revenue stream allows for long-range planning of services provided and infrastructure operation.

Community needs and regulatory requirements may change over time. Since stormwater utility fees are scalable, they provide important flexibility to adapt to changing conditions.

The ultimate goal of the stormwater utility is not simply to raise revenue but to properly manage stormwater. Statutorily-mandated, partial fee credits may incentivize property owners to take action, particularly through the implementation of stormwater best management practices (BMPs) such as green infrastructure that reduce the quantity of stormwater discharged from the site and thus protect water quality.

Designing the Fee

The first step in designing a local stormwater user fee is to document the existing cost of stormwater services (i.e., current service level). See here for information on determining your base budget for stormwater spending.

To estimate the projected additional cost of pursuing a higher level of service, the locality’s existing Stormwater Management and Asset Management Plans should be reviewed. (If such plans do not exist, they should be developed.) What projects are needed to address chronic flooding or water quality issues and what level of investment is required to maintain a state of good repair? What level of annual operation and maintenance expenses are necessary to maintain the stormwater system and service delivery? Together, this current and projected capital and operation and maintenance cost of service analysis answers a key question for the fee calculation process outlined below: how much annual spending is needed to achieve the community’s vision?

It is also good practice to integrate these operating and capital cost estimates into a long term (i.e., five or ten year) financial forecast. In the plan, other aspects such as a reasonable annual reserve amount should also be considered for unforeseen contingencies. Financial plan development is an iterative process that helps determine the pace of planned capital and operations program improvements at different fee levels.

A fundamental tenet of utility rate setting is the equitable allocation of costs to customers based on their use of the service. For example, water utilities use a water meter to determine a customer’s monthly bill. While it is not possible to replicate that approach for stormwater, it is possible to establish a fee based on a “…fair and equitable approximation of the proportionate contribution of stormwater runoff from a real property…” as required by the enabling statute, using the measurement of hardened surfaces, impervious area, as the basis of the user fees.

According to the “2018 Stormwater Utility Survey” published by Black and Veatch, 92 percent of the survey respondents indicated that they use impervious coverage (e.g., hardened surfaces, such as driveways and roofs) as the basis for their fees. Since impervious coverage strongly influences the amount of stormwater volume, the rate of runoff, and the amount of pollution produced by each property, it serves as a reasonable surrogate to determine the proportion of stormwater contributed by a particular property, and thus satisfies the proportionality test. [1]

To construct a fee system in this manner, impervious coverage data must be estimated or each parcel of property. The most reliable method for this “parcel analysis” involves the use of aerial imagery, land feature delineations, and geographic information systems (GIS) tools. Other approaches to estimate impervious area include leveraging local tax assessment data if it has reliable data on various types of improved surfaces within a property. When evaluating the ‘best-fit’ approach to determine impervious area, it is important to consider aspects including data availability, quality of the data, ease of compilation, ongoing data management and administration.

In the absence of readily available, measured impervious area data for residential properties, which tend to have less variation, the average impervious area may be developed through statistical sampling and used as a basis for charging all single-family residential properties. For non-residential parcels, which typically have significant differences in the level of impervious area, a locality may have to measure impervious area for each parcel, using available technology and digitization. (I.e., Specific measurements would be derived by digitizing impervious area from aerial imagery.)

[1] Other, less popular alternatives for establishing a fee basis include the gross area of a property, often accompanied by measures of either runoff or the intensity of development (e.g., the ratio of impervious to gross area), as well as the equivalent hydraulic area which compares the impervious and pervious portions of a parcel, which helps approximate runoff from undeveloped land.See here for a detailed discussion of the rate structure options.

See here for detailed information on offsetting fee credits.

“What is the “average” stormwater utility fee?” is a common curiosity question. A quick review of the 2019 Western Kentucky University Stormwater Utility Survey suggests an amount of $5.85 per month for a single family residence. In actuality, the fee for each locality is unique, a product of several factors that vary widely across different localities, including the age of its stormwater infrastructure, spending needs, regulatory requirements, and the very basic decision over how much of the total cost the fee should cover.

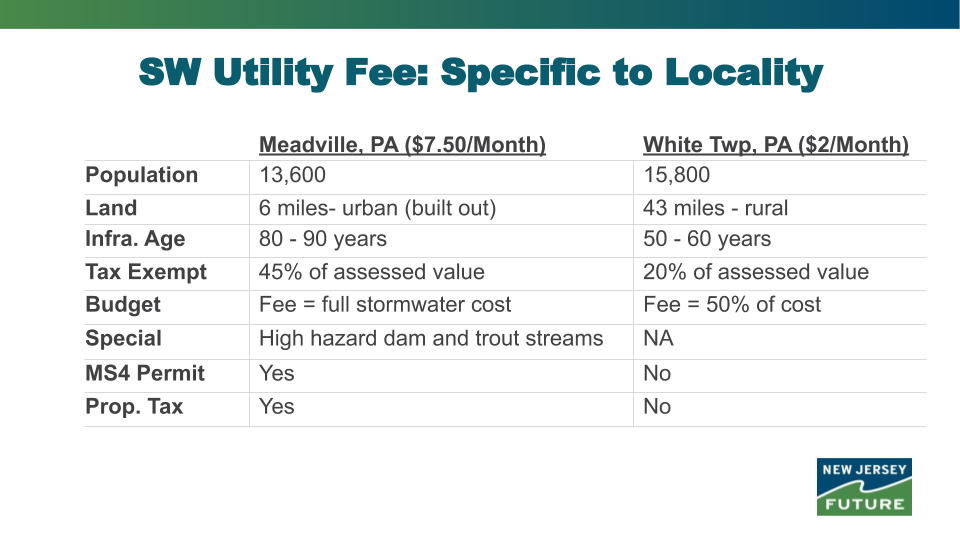

For example, consider this comparison of two Pennsylvania towns, Meadville and White Township. Though their respective populations are very similar, the monthly fee in one town is nearly four times that of the other. Importantly, note the stark differences in their characteristics.

In other communities, a different set of distinguishing characteristics could easily come into play: affordability, proactive or reactive outlook, commercial/industrial versus bedroom community, and regional versus local flooding or water quality issues. Each could affect the level of the fee.

- Stormwater Utility Fee Development Basics – provides an in-depth view of the standard fee calculation process.

- See here for information on Combined Sewer Overflow – Cost Allocation

These factors could increase spending or reduce revenue in the future, prompting fee adjustments:

- Phase-in or phase-down of capital projects

- Fee credits: gradual growth in number or type

- Data updates (e.g., impervious coverage)

- Fee appeals

- Billing adjustments

- Regulatory changes

- Cost of providing service (eg. energy costs)